Even if you got both PPP Loans... businesses STILL qualify and receive a sizable ERC refunds. Apply Today!

"FREE Money" For Small Businesses

This is not a loan. It's a refundable tax credit. Up to $26,000 per employee. You don't have to pay it back. You can use it for any purpose.

NO COST, NO OBLIGATION, NO RISK. SUBMIT THE FORM BELOW TO FIND OUT IF YOU QUALIFY - FOR FREE

Learn How You Can Qualify For ERC Funds Completely FREE For Your Business

I PROMISE, You will NOT BE SOLD anything. This is a completely FREE Opportunity

The Employee Retention Tax Credit

Maximizing Your Claim For Keeping Americans Employed During Covid-19

The government has authorized $400billion, and yet billions of dollars will go unclaimed

Retained Employees During Covid-19

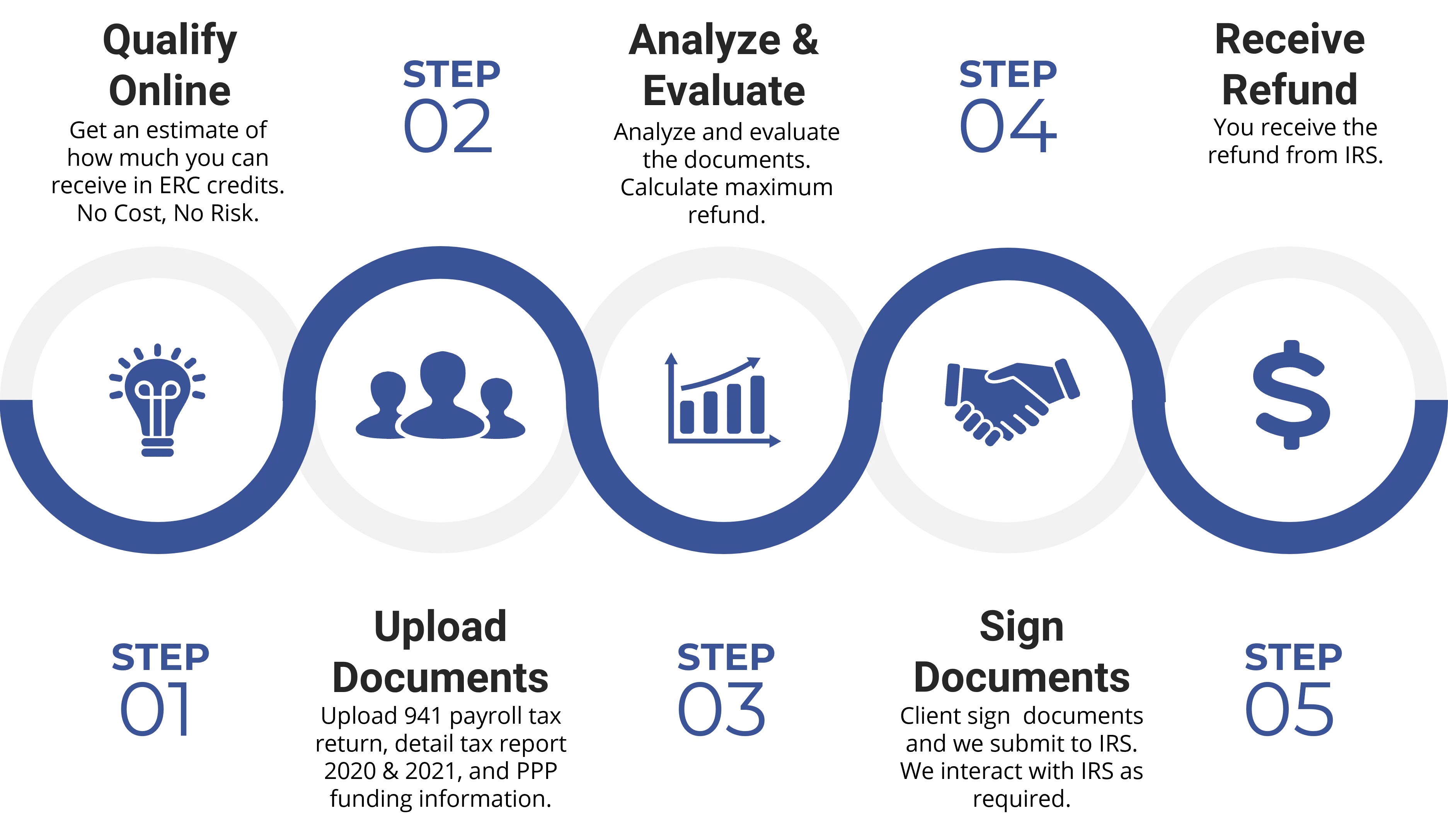

The ERTC was established by the CARES Act (Coronavirus Aid, Relief, and Economic Security Act). It provides a credit to business owners based on qualified employee wages and health plan expenses paid after March 12, 2020 and before Oct 1st, 2021.

No Restrictions, No Repayment

The ERTC was created in the CARES act along with the PPP Loan program. Receive ERTC funds even if you've received a PPP loan. The ERC is not a loan, there is no repayment. Recipients of funds have no restrictions on how to use the funds received.

Up to $26,000 Per W-2 Employee

Eligible employers can claim max $5,000 per employee for 2020 (from 3/12/20) and max $7,000 per employee per quarter (Q1 - Q3). That is a potential of up to $26,000 per employee. Business start-ups after Feb 15, 2020 can take a credit of up to $50,000 in both Q3 and Q4 of 2021.

Free, No Obligation Pre-Qualification

Is Your Business Eligible?

To qualify, your business must have been negatively impacted in either of the following ways:

Partial or full shutdown of your business due to government action

A government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel or restrictions of group meeting.

Reduction in gross receipts

Gross receipt reduction criteria is different for 2020 and 2021, but is measured against the current quarter as compared to 2019 pre-COVID amounts.

Must the business be eligible for all quarters?

Not at all. A business can be eligible for one quarter and not another, but still receive an ERTC refund.

The business has received a PPP loan, can we still get a ERC refund?

Initially, under the CARES Act of 2020, businesses were not able to qualify for the ERTC if they had already received a Paycheck Protection Program (PPP) loan. With new legislation in 2021, all employers are now eligible for both programs. The ERTC, though, cannot apply to the same wages as the ones for PPP.

Why Choose Us?

Focus

We focus solely on Employee Retention Tax Credits assessment, preparation, and filings of our clients. Due to our experience and enterprise-level capabilities that enable us to support thousands of direct clients, payroll firms, and CPA practices across the nation we have become the leading ERTC Company in the United States

Maximize Your Claim

Our teams of ERTC specialists pride themselves on understanding your business to a degree that enables them to identify the best possible ways to maximize your ERTC eligibility.

Highly Responsive Support Team

Whenever you have questions or need help, our highly responsive ERTC support team will be there to give you the answers you need.

Upfront Pricing, No Hidden Costs

Our pricing structure is transparent. There are never hidden costs.

Get IRS Support

We fully stand behind our work. We provide full audit support if any of your ERTC claims are ever challenged by the IRS.

Find Out What Our Accounting And Legal Professionals Can Secure For Your Business Today

These are just some of the businesses we have helped in the past

Gym Client

Refund: $471,880.92

Senior Care Client

Refund: $5,303,912.25

Restaurant Client

Refund: $901,489.83

Trucking Client

Refund: $2,001099.15

Construction Client

Refund: $1,103,588.30

Don't Let Any Misconception Hold You Back From Claiming Your ERC Credit

The ERTC tax incentive is heavily underutilized due to misconceptions surrounding eligibility. Take a look at some of the most common ERTC misconceptions.

We Had No Revenue Decline

Revenue is one of many factors that determine whether you qualify for ERTC. In fact, companies without a considerable revenue decline can still qualify for the employee retention tax credit.

Our Business Is Not Essential

Your business does not have to be deemed essential to qualify for employee retention tax credit.

We Have Received A Paycheck Protection Program Loan Before

Companies that have received one or both PPP fundings are eligible for the employee retention tax credit.

We Never Shut Down Our Business

The ERTC tax incentive has several provisions that make it possible for employers who were not forced to completely shut down their business to qualify for the ERTC. Businesses that were forced to partially shut down their business can make a claim. Additionally, those businesses without a government mandate to shut down or partially shut down their business can still qualify through revenue decline.

Our Revenue Went Up After A Shift In The Market

Although your revenue increased for the year, many companies experienced declines in one or more quarters in 2020 and/or 2021 when compared to 2019. These short-term revenue declines allow you to qualify even with increased annual revenues.

It’s Too Late To Apply For The ERTC

If eligible, employers can claim the ERTC for qualified wages paid in 2020, as well as Q1, Q2, and Q3 of 2021. The statute of limitations for the 2020 ERTC does not close until April 15, 2024. The statute of limitations for the 2021 ERTCs does not close until April 15, 2025.

What Our Clients Are Saying

Frequently Asked Questions

Qualification

Tax Credit

General

© Copyright 2023 . Trebor Business. All Rights Reserved.

Designed by Trebor Digital Agency | Powered by GROOVE